Comment regarding the need to call off the Greek lignite sale.

The comment was published in Carbon Pulse on January 25, 2019. The full text of the corresponding article follows:

Greece again postpones sale of lignite stake amid appeals to call off process

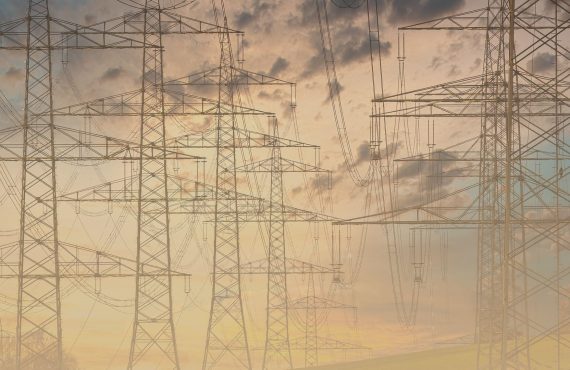

Greece has postponed the EU-mandated sale of lignite power assets while green groups urge Brussels to halt the process they say would pile costs on citizens and delay climate action.

Just ahead of the Jan. 23 deadline, the government pushed back the end date to Feb. 6 for parties to submit their bids for a 40% stake in state-controlled utility PPC’s lignite power plants and associated mines.

“This is the fourth time the sale has been postponed and I would view this deadline as highly unlikely as well because there are so many things in the air,” said Nikos Mantzaris of environmental institute The Green Tank.

The potential bidders in the process are all seeking improved sale terms, according to Greek news service energypress.

They want at least half of the 1,250 workers across the facilities off the books, but PPC is struggling to push through these redundancies, with fewer than 300 employees accepting deals, Mantzaris said.

Meanwhile, the bidders are seeking assurances that a provisional EU deal on electricity market reforms agreed last month will enable Greece to award long-standing capacity payments this year ahead of eligibility limits that would bar big-emitting lignite units.

That deal was signed off by member state officials last week and the EU Parliament’s cross-party industry committee this week – procedural hurdles that leave only a rubber-stamping by the full EU Parliament due Feb. 28 and national ministers at any upcoming Council meeting before the law can come into force.

A spokesperson for the Greek energy and environment ministry was not immediately available for comment.

BAILOUT PLEA

Debt-ridden Greece is keen to complete the sale process as a condition of the terms of its third international bailout of up to €86 billion, for which the EU is the main creditor.

The creditors’ idea was that the lignite sale would help ensure more competition in the Greek electricity market, ultimately driving down prices for consumers.

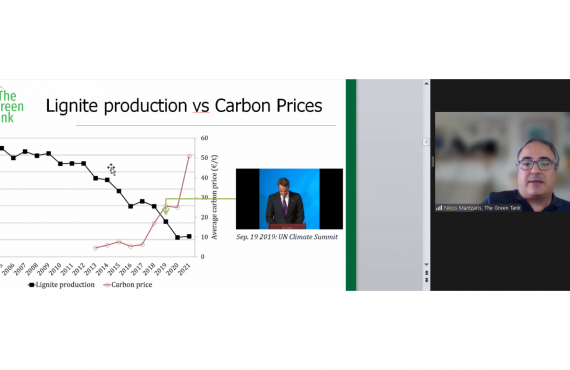

But several EU-wide green groups are appealing to the EU to withdraw the sale condition, arguing that it is forcing Greece to delay its low-carbon transition and will – partly due to the prospect of higher EU carbon prices next decade – pile more costs on Greek households.

“If unchecked, this sale will have negative impacts on Greece’s clean energy future and the competitiveness of the Greek economy, and stand in the way of a Just Transition for Greece,” Europe Beyond Coal managing director Mahi Sideridou said in a letter to the European Commission on Thursday.

The letter, seen by Carbon Pulse, was also signed by CAN Europe, ClientEarth, and The Green Tank. In the wake of a quadrupling of EU carbon prices over the past two years to above €20 – laying more costs onto PPC to cover its lignite-based emissions – the Greek government has said it was considering charging households a CO2 levy.