The Green Tank contributed with comments to the public consultation on updating EU legislation to make the EU independent from Russian fossil fuels (REPowerEU). Specifically, this initiative concerns the Proposal for a Regulation amending Regulation (EU) 2021/241 as regards the REPowerEU chapters in Recovery and Resilience Plans.

The European Commission’s proposal contains two problematic points regarding the funding of REPowerEU:

1. The use of allowances currently outside the carbon market to raise the amount of €20 billion.

2. The waiving of the Do No Significant Harm principle for investments identified as important for energy security.

In its comments, Green Tank explains the possible consequences of implementing these measures and submits proposals.

The full text follows:

Funding of the REPowerEU plan by auctioning allowances from the MSR worth 20 billion (articles 4 and 5), is a really dangerous measure which must be avoided. A few months back the European Commission rightfully refused to allow Member States to bring forward their share of allowances and auction them in order to tackle the energy price crisis because that would undermine the carbon price, and now it proposes a far more damaging measure.

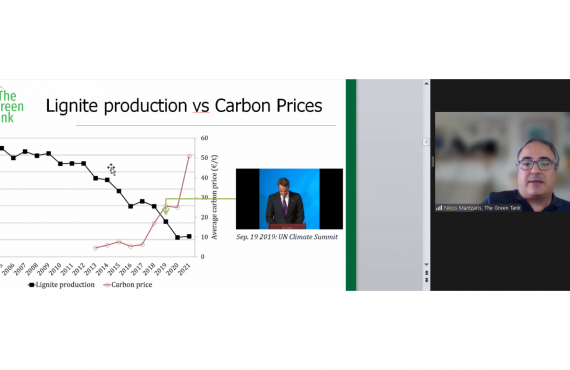

First, it will decrease the carbon prices, thus reducing the efficiency of the EUETS, which has undoubtedly been EU’s most effective climate policy tool since the rise in the carbon prices in the second half of 2018. Especially since this measure will send a message to all carbon market participants that the EU will interfere with the market whenever it is arbitrarily decided that extra funds are necessary or the carbon price is too high. This will in turn threaten a more structural come-back of coal and lignite across Europe, thus, jeopardizing EU’s 2030 climate targets (both EU ETS and overall).

Second, as analysis by Sandbag shows, it is highly possible that the extra allowances auctioned will not return back to the MSR by the end of the 4th EUETS phase, thus risking extra emissions to the atmosphere and further undermining the achievement of the EU climate targets.

Overall, considering the relatively low amount of money that will be gathered and the potential damage caused by this measure, it becomes clear that alternative funding sources should be pursued. In case funding from the EU ETS is the instrument of choice, then one way of gathering 20 billion would be through a speedier phase out of free emission allowances which are currently being offered to the energy intensive industry in excessive quantities, and are to a large extent responsible for the fact that industrial emissions remain high. If a forward bearing phase out trajectory of free emission allowances is chosen, the extra funds collected from the auctioning of these allowances, could be used to fund the REPowerEU plan, without risking destabilizing the carbon market or releasing more greenhouse gases to the atmosphere. An additional benefit of such a measure would be the creation of incentives to decarbonize industrial processes and the utilization of a much larger Innovation Fund (or Climate Investment Fund) for this purpose.

Another very dangerous aspect of the proposed chapters of the Regulation on REPowerEU in Recovery and Resilience Plans is the waiving of the Do No Significant Harm (DNSH) principle for investments “contributing to security of supply” (article 21). First of all, such fundamental principles should not be put aside in crises. It is especially in crises that such principles and corresponding objectives should be reinforced, as was the case with the handling of the covid pandemic 2 years ago when the commitment of the EU to climate neutrality and all provisions and goals of the Green Deal were tested and doubted but finally reinforced.

Second, there is no proof that security of supply is not feasible without waiving the DNSH principle. In fact, there is the analysis of four think tanks (Ember, RAP, E3G, Bellona) which shows that it is possible to eliminate the dependence on Russian fossil gas faster than the REPowerEU plan through a speedier and larger-scale deployment of renewables, and heat pumps, a reduced amount of gas from other sources and without any new fossil gas infrastructure.

Third, the DNSH principle is the only “shield” in the RRPs preventing investments in fossil fuels, including coal. Waiving it, especially in conjunction with a reduction in carbon prices caused by the auctioning of MSR allowances, might create incentives for prolonging the lifetime of coal plants across Europe further, with devastating effects for the climate.