The progress of renewables in Greece is threatened by the upturn in gas use – especially Russian gas – as a result of falling prices and the ‘take-or-pay’ clauses that bind the country to Gazprom, noted Ioanna Souka, Data Analyst, speaking to Energy Intelligence.

The statement was made in response to a report titled “Greece’s Gas Exports Drop to Almost Zero in Q1”, which presents DESFA data showing that in the first quarter of 2024 Greece’s gas exports fell by 95%.

Commenting on this development, Ioanna Souka underlined that once again there’s a risk that the new LNG infrastructure, which the country is planning with exports as its central objective, could turn into stranded assets.

According to DESFA, the rise in domestic consumption, as well as the fact that Bulgaria has increased gas imports from Turkey, are the two main reasons for the sharp drops in Greece’s gas exports.

On the other hand, Greece’s dependence on Russian gas is growing: based on The Green Tank’s analysis for March 2024, Russian gas imports from the Sidirokastro gate were up 50.3% compared to the same month last year, while exports from the same gateway are at 0 as of September 2023.

Meanwhile, Russia remains the second largest LNG exporter to Greece – after the US – with flows up 82% in the first quarter of this year.

Apart from the rise in gas consumption in Greece (+31% in the first quarter of 2024), the increase in Russian gas imports is also due to Greece’s obligations to Gazprom and the take-or-pay clauses that it has agreed with the Russian company.

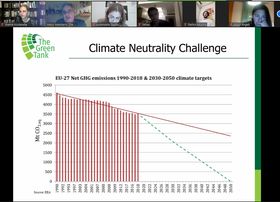

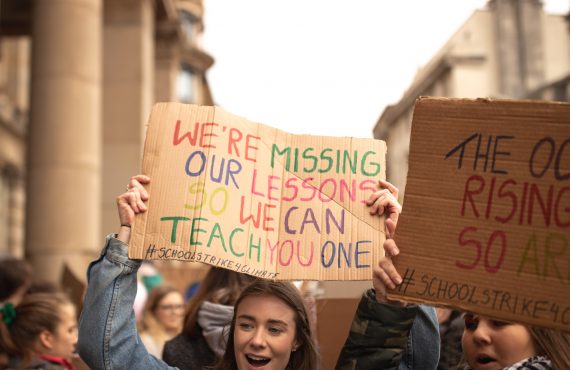

In this light, a pertinent question arises: will Greece be able to meet the target of 90% of electricity generation from renewable energy sources in 2030 that it has set in the most recent version of the NECP?

This article was published on 23 April 2024 and is available with a subscription on energyintel.com.