Nikos Mantzaris discusses with journalist Cristina Brooks the developments leading to the recent decision by PPC and the Greek government to move forward the lignite phase out by 3 years, to 2025, and how Greece’s last lignite plant, Ptolemaida 5, can be converted into a sustainable renewables-based energy storage facility providing cheaper electricity than a fossil gas plant which is currently PPC’s default plan for the post-lignite future of Ptolemaida 5.

The article was published in IHS Markit on April 30,2021 under the title:

Greece rushes to exit coal amid carbon price surge

The full article follows.

Greece will stop burning coal for power plants in 2025, three years earlier than expected, State Secretary for Energy Alexandra Sdoukou announced on 22 April.

Greece is the tenth European country to have already exited coal or announced a plan to do so by 2025, according to nonprofit Europe Beyond Coal.

The state’s decision to move forward a planned 2028 coal phase-out date aligns with the target of its state-controlled utility and coal mine operator Public Power Corporation (PPC).

PPC’s move is in anticipation of future EU regulations, for example limiting the use of solid fuels like coal, that could potentially result from the EU’s Green Deal package that will implement its recently-agreed 55% emissions target, or the EU’s financing offered to fossil-fuel-dependent nations through the Just Transition Mechanism.

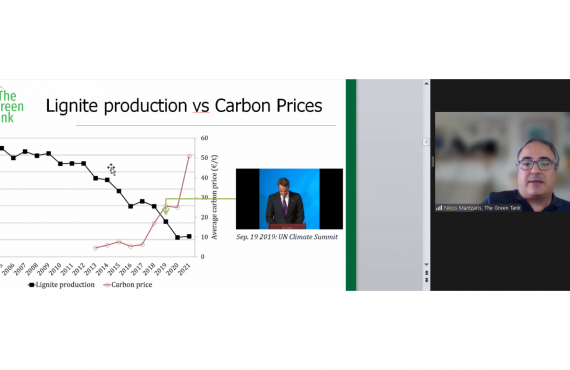

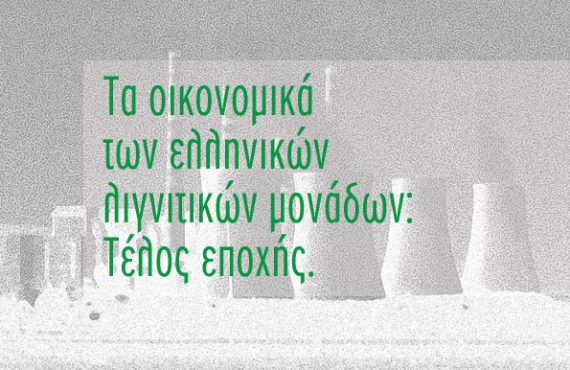

In its 2020 annual results, the operator also blamed the lower competitiveness of its coal-fired power plants on the high price of carbon allowances for its coal generation and a “rigid environmental regulatory framework.”

In a year in which electricity demand dropped 8% due to the pandemic, PPC had cut its coal-fired generation nearly in half due to lower natural gas prices and higher CO2 prices, which made its coal-fired units less competitive than its natural gas units.

The utility advanced plans to convert its then under-construction 660-MW coal-fired power unit, Ptolemaida V to a natural gas-fired unit by 2025. Ptolemaida was due to operate from 2022 to replace older units and run a district heating system.

In addition, PPC’s coal mining operations, intended to supply the new unit with lignite, will stop in 2024 instead of 2028.

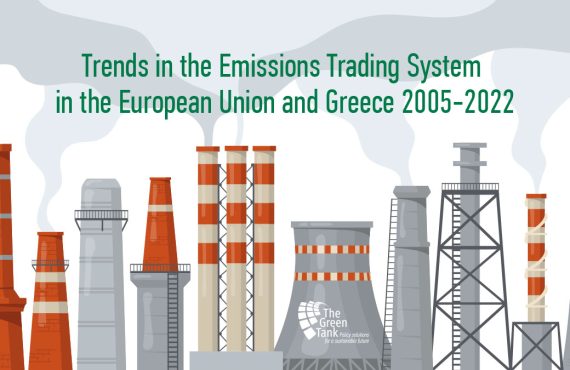

In January 2019, the European Commission reformed the EU Emissions Trading System (ETS) Directive with a mechanism intended to spur incentives to cut emissions by raising carbon prices.

As part of this reform, the EC introduced the Market Stability Reserve to slash the surplus of EU ETS allowances (EUA) that had arisen after the 2008 recession caused a drop in emissions.

Following the cut in the surplus, EUA prices rose steadily, reaching their highest-ever level in November, and then continuing upwards to €47.03/t CO2 equivalent on 22 April. This higher price comes down especially hard on coal operators, which have to purchase more EUAs than less-polluting gas operators.

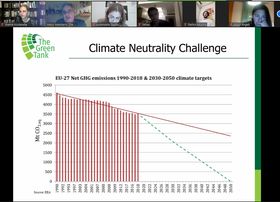

Another reform of the EU ETS coming up this year is expected to accelerate the trend. “As the EU is preparing for a new reform in a few weeks in order to align the sectors in EU ETS with the new 2030 EU climate target, carbon prices are expected to escalate even more,” said Nikos Mantzaris, senior policy analyst for Greek nonprofit The Green Tank.

The type of coal (lignite) typically mined in Greece doubles the sector’s pain. “The Greek lignite industry is particularly vulnerable to any kind of change with an economic impact, such as the cost of CO2, because Greek lignite has, by far, the worst quality in the EU, having, among other things, the lowest energy content. In other words, you get the smallest bang for your buck,” said Mantzaris.

PPC raises green ambition, bonds

In the context of a shift away from coal and towards renewables last year, PPC signed an agreement with German energy company RWE to develop renewable energy projects in Greece through its subsidiary, PPC Renewables.

PPC also made several successful green bond issuances in March that it said will help finance projects. For example, PPC offered sustainability-linked senior notes totaling €775 million (US$932 million) through two issuances, one of which was oversubscribed by six times the amount of notes offered.

The bonds will help underwrite its overall environmental strategy, which includes a drop in CO2 emissions by 40% by 2022 under 2019 levels. PPC plans to phase out its existing 3.4 GW of coal power capacity by 2023.

PPC is already making headway in renewables. Its renewable energy pipeline has reached more than 6 GW, the largest in the country, of which 1.5 GW in capacity will be up and running by the end of 2023.

Mostly, the pipeline includes solar, but it also encompasses wind, hydropower, and other renewables. Some PV generation will be rolled out at PPC’s depleted lignite production fields alongside the decommissioning of its lignite-fired generation assets.

But despite this progress, environmental advocates are fighting for PPC to stop burning fossil fuels altogether.

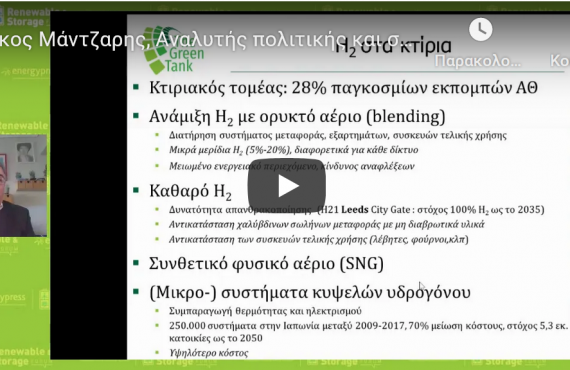

They say converting Ptolemais V to an energy storage facility would be cheaper than switching to combined-cycle gas turbines because of projected carbon prices, according to a recent paper by the Green Tank, legal charity ClientEarth and German energy consultancy Enervis.

As it stands, the gas-fired unit will be in violation of Greece’s National Energy and Climate Plan submitted to the EU as a condition for obtaining EU pandemic recovery funds, said nonprofit Europe Beyond Coal.

To be eligible for funds, Greece would need to be fully compatible with the EU’s new 2030 emissions target and the climate-related parts of the EU Taxonomy Regulation agreed two weeks ago.

Greece swaps coal mining for PV

However, Greece is currently drawing up Territorial Just Transition Plans (TJTPs) for its coal mining regions, as required to access financing under the EU’s Just Transition Fund.

In 2019, the Greek government formed a committee to work on transitioning its Western Macedonia and Megalopoli coal mining regions.

In September, the committee opened a public consultation on a long-term plan to transition to a post-coal industry in the two regions.

Solar power is a major feature of that plan. The Greek government had set a goal to install 2 GW PV through its PPC company’s partnership with RWE. This includes an agreement between Greek oil company Hellenic Petroleum and the German company Juwi on the construction of a 204 MW photovoltaic park in Kozani.

The Greek government is also currently working on a legislative framework for energy storage and offshore wind farms.