A 21.7% decrease in fossil gas consumption in the first half of 2023 compared to 2022 and an 18.1% decrease compared to the 5-year average. Domestic consumption of specifically Russian gas decreased by 62.9% compared to the first half of 2022, despite an increase in imports from Russia in June.

The month of June

According to the latest available data from DESFA, in June 2023, total domestic gas consumption was 4.27 TWh. Despite a 34% increase in consumption compared to May, mainly due to an increase in gas use in industry by 0.16 TWh, there was a decrease both compared to June 2022 (-0.36 TWh) and the five-year average (-0.3 TWh). The overall decrease compared to June 2022 was driven by electricity production (-0.55 TWh), since in industry and distribution networks the consumption was increased (+0.18 TWh and 0.01 TWh respectively).

Cumulative performance in the six months

Overall, for the first six months of 2023, gas consumption was 23.72 TWh, reduced compared to the same period of the previous five years (-5.25 TWh or 18.1%) and even more so when compared to the first six months of 2022 (-6.59 TWh or 21.7%).It wasthe second lowest consumption compared to the corresponding period of the previous five years, following the first six months of 2018 (23.29 TWh).

It is worth noting that all gas uses appear reduced compared to the five-year average. The largest decrease in absolute terms was in electricity (-3.04 TWh), followed by industry (-1.87 TWh), which showed the largest percentage decrease of 49.5%, and then networks (-0.34 TWh). This picture changes when comparing the first six months of 2023 with the same period of 2022, as industry recorded an increase of 14.3% (+0.24 TWh), while in electricity production and networks the consumption decreased (-5.35 TWh and -1.48 TWh respectively).

Consumption in 2023

After the historic low of May 2023 consumption compared to the same month of the previous five years, in June 2023, gas consumption (4.27 TWh) increased compared to the previous three months of the year, but again decreased by 7.7% compared to June 2022.

Regarding the distribution of gas consumption in end-uses, in the six months of 2023, the decrease in gas use in electricity production also reduced its share in end-uses to 63.4% (from 67.3% in the six months of 2022). In contrast, distribution networks increased their share to 28.5% in the first six months of 2023 (27.2% in 2022), while there was a larger increase in industry of 8.1%, almost two and a half percentage points higher than in 2022 (5.5%).

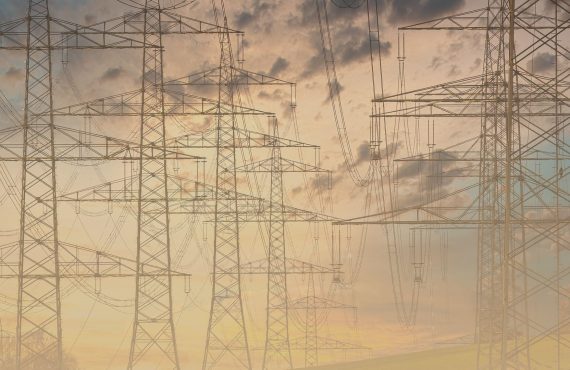

Imports in 2023

In terms of fossil gas flows from Greece’s four gateways, in June 2023, gas imports from Russia covering domestic consumption were increased by 0.8 TWh compared to the same month in 2022 [1], when the lowest imports of Russian gas for the month of June in the last 5 years (0.22 TWh) were recorded; however, in June 2023 (1.02 TWh) imports from Russia with a share of 22.6% ranked second lowest in terms of Russian gas imports compared to the same month in the last six years. In contrast to the Sidirokastro gate at the other three gates gas flows appeared reduced compared to June 2022. The Agia Triada gateway, with a liquefied fossil gas (LNG) flow of 2.72 TWh in May, continued to be the main source of entry with a 60% share of total fossil gas flows imported by Greece, although reduced compared to the same month last year (-29.4%). An even greater decrease compared to May 2022 was recorded in imports from TAP via Nea Mesimvria (-38.3%), which contributed 0.6 TWh and a share of 13.3% of the country’s total imports. Much lower was the share covered by flows from Turkey via Kipoi (4.1% or 0.18 TWh), which were decreased by 27.1% compared to June 2022.

Cumulatively for the first six months of 2023, total imports from the four entry gateways into the country were 26.66 TWh. LNG imports through Agia Triada ranked first among the supply sources with 18.69 TWh – an increase of 7.9% compared to the same period in 2022 – and a 70.1% share. In contrast, there was a large 37.6% decrease in Azerbaijani gas imports via TAP, which with 4.43 TWh and a share of 16.6%, continued to rank second in the first six months of 2023. However, Russian gas imports covering domestic consumption decreased even more, as they shrinked to 62.9% compared to the same period in 2022. Thus, with just 2.56 TWh and a 9.6% share among the four entry gates, Russian gas covering domestic consumption ranked third among Greece’s supply sources. Finally, the lowest contribution continues to be made by gas imported from Turkey through the gateway of Kipoi, with only 0.98 TWh and a share of 3.7% in the first six months of 2023.

Comparison with the European Union

Based on the latest available Eurostat data on monthly gas consumption in the EU-27 Member States for the first 5 months of 2023 [2], Greece managed to reduce its consumption by 24.4% compared to the same period in 2022, ranking 4th in the EU-27 (except Slovakia), 11 places higher than the average (-11.7%). First with four percentage points higher than Greece, wass Sweden with -28.4%.

The reduction achieved by Greece was larger than the EU-27 average compared to the five-year average as well. More specifically, with -21.6%, Greece ranked 11th, about 6 percentage points higher than the EU-27 average (-15.4%), which ranked 19th.

Using the latest available Eurostat data on both monthly gas imports via gas pipelines and LNG (up to April 2023), it is observed that Greece has managed to reduce its dependence on Russian gas more than the EU-27 average.

Cumulatively in the first quarter of 2023 Greece reduced gas imports from Russia by 60.3% compared to the same period in 2022, more than the EU-27 average of -49.1%. This happened despite the fact that especially for the month of April, the opposite trend appeared as the decrease in Russian gas imports compared to the same month in 2022 was lower in Greece (-31.9%), than the EU-27 (-49.8%).

You can read the analyses of other months here.

[1] Overall imports from Russia were higher in June 2023, but all of these were exported to Bulgaria and as a result only 1.02 TWh were used for domestic consumption.

[2] Some of the Eurostat data, especially for the last few months, are provisional and will be finalized in the coming months. Slovakia is not included in the comparison as April and May gas consumption is missing.