In August 2022, gas consumption decreased by 15.3% compared to August 2021 mainly due to a reduction in industrial use by almost 80%. However, consumption is up by 6.9% compared to the five-year average, leaving Greece far from the European Commission’s target for a 15% reduction compared to the five-year average.

In force: European obligation to reduce fossil gas consumption during the period August 2022-March 2023 by 15% compared to the average of the same period of the previous five years or 2021, if the consumption had increased by more than 8% that year, a derogation for which Greece is eligible.

More specifically, according to the latest available data from DESFA (until August 2022):

The month of August

August 2022, the 1st month of the eight-month period during which the country has to reduce gas consumption in line with its European obligations, and total domestic consumption was 5.35 TWh, 0.96 TWh lower than that of August 2021 (6.31 TWh), but 0.35 TWh higher than the average August of the last five years (5 TWh). The overall decrease of 0.96 TWh compared to last year’s levels was primarily due to the large reduction in fossil gas use in industry by 0.63 TWh and secondarily in electricity generation by about 0.3 TWh, while the decrease compared to August 2021 was much smaller in distribution networks (-0.03 TWh).

The European target of -15%

August’s consumption was much higher (+1.1 TWh) than the EC’s 15% reduction target compared to the five-year average (4.25 TWh). In terms of percentage changes, the country in August 2022 reduced its total consumption of fossil gas by 15.3% compared to the same month in 2021, meeting the reduction target resulting from the derogation granted to Greece in the relevant European agreement. On the contrary, compared to the five-year average – applied for the month of August-, there was a 6.9% increase in consumption, leading to an excess of 25.7% compared to the European Commission’s 15% reduction target.

As far as final uses are concerned, it is noteworthy that in August 2022, the first month of the reduction period, all final uses show significant reductions compared to the same month in 2021. Industry leads the way (-79.5%), followed by distribution networks (-7.4%) and electricity generation (-5.8%). In contrast, compared to the five-year average, only industry shows a decrease, and a very significant one (-75.9%), while the largest, by far, fossil gas end-user, electricity generation, shows a large increase of 21.2%. Consumption in distribution networks also shows a smaller increase (+5.1%).

Consumption in 2022

Cumulatively for the first 8 months of 2022, fossil gas consumption was 11.3% lower than in the same period in 2021. August is included in the six months of the year so far where there was a decline compared to the same month in 2021 (January, April-August) and the fifth consecutive month of decline, with the largest monthly decline occurring in April (-46%).

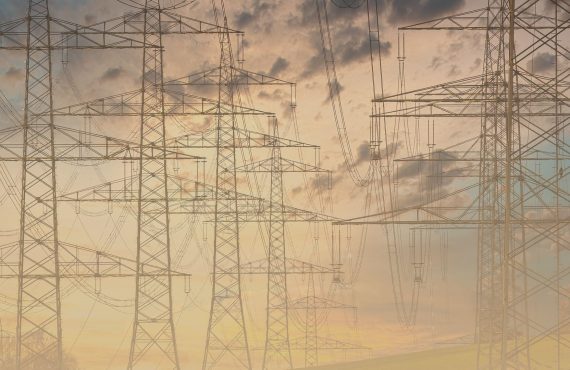

Imports in 2022

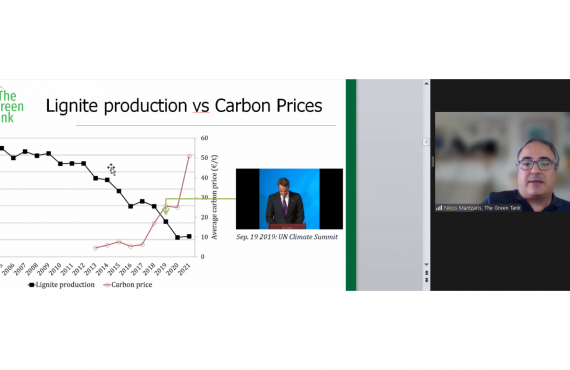

In terms of fossil gas import flows from the country’s four entry points, in August 2022, liquefied natural gas (LNG) from the Agia Triada entry point experienced an increase of almost 73% compared to the same month in 2021 and was by far the main source of gas for Greece with 3.74 TWh and a 68% share of the total fossil gas flows imported by Greece. On the contrary, there was a large (75%) decrease in Russian gas imports from Sidirokastro covering domestic consumption, which amounted to just 0.76 TWh[1] more than double, however the quantity imported in July 2022. Imports from TAP via New Mesimvria were also reduced by 35% to 0.71 TWh, while imports from Turkey via Kipoi, which were zero in August 2021, reached 0.31 TWh.

Therefore, cumulatively for the first 8 months of 2022, Russian gas imports to meet domestic consumption decreased by 58.4% compared to the same period in 2021. Thus, with less than 8 TWh and an 18.3% share among the four sources of imports, Russian gas has now fallen to third place from the first position it held in the first eight months of 2021. In contrast, LNG imports via the Agia Triada entry point moved into first place reaching 24.8 TWh and a share of 56.7%, an increase of 53% compared to 2021. Gas imports from Azerbaijan via TAP also saw a smaller increase of 7.7% to 9.5 TWh (21.7% share), surpassing Russian gas imports for the first eight months of 2022. Finally, there was a large decrease of almost 50% in cumulative imports from the fourth and smaller source of Turkish gas via Kipoi, which amounted to 1.4 TWh (3.3% share).

Comparison with the European Union

Based on the latest available Eurostat data on monthly gas consumption in the EU-27 Member States from January until July 2022, Greece has reduced its consumption by 10.6% and is in the 15th place in the relevant ranking, one place above the EU-27 average (-10.1%). However, with respect to the 5-year average, Greece has the 3rd worst performance in Europe (behind Slovakia and Malta) as it has increased its consumption by 7.1% compared to the same period in 2021, mainly due to the jump in gas use in 2019-2021.

Greece is less dependent on Russian gas for the first seven months of 2022 compared to the EU average. Each month of 2022 Greece managed to reduce the imports of Russian gas used to cover domestic consumption compared to the same month in 2021, much more than the EU average. Thus, cumulatively until July 2022, Greece reduced Russian gas imports by 55.2% and the EU-27 by 7.6% compared to the same period in 2021.