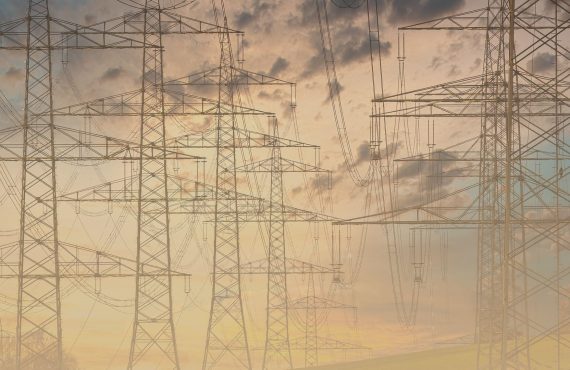

As renewables grow fast in Greece, displacing polluting fossil fuels and containing the energy prices, plans to create news gas infrastructure in the country are debated. Contributing to a news report by Energy Intelligence, titled “Greece Focuses on Exports as LNG Regas Capacity Grows”, Ioanna Souka, Data Analyst, argued that “there is a serious risk that the planned new LNG infrastructure will end up being stranded assets”.

In fact, the article highlights the excess planned regas capacity of the new FSRU projects – Alexandroupolis, Dioriga Gas, Argo and Thessaloniki -, given that gas demand in Greece, neighbouring counties and the EU is on downward trend. To shed light on this, the news report draws on Greece’s draft National Energy and Climate Plan, launched in November 2023, which mentions the Alexandroupolis and Dioriga Gas projects “as creating ‘an appropriate infrastructure capacity margin.’ The other projects will be considered in the context of the possible additional gas transit needs since market forecasts point at no need for additional gas import infrastructure to supply the domestic market”.

Commenting on this, Ioanna Souka said that “the new LNG terminals are not designed to contribute to the energy security of the country, but aim at making profits from exporting to neighboring countries.” This argument relies on data showing that Greek gas consumption dropped 10% year on year to around 4.4 Bcm last year, after falling 19% in 2022, while renewables continue to rise. At the same time, as Ioanna Souka underlines, even the country’s sole 7 Bcm/yr Revithoussa regasification terminal could remain underutilized as its record 3.3 Bcm intake of 2022 is still more than Greece’s expected 2030 domestic demand of circa 3.2 Bcm.

The news report was published on February 20, 2024 and it is available on demand at energyintel.com.