There were zero imports of Russian gas for domestic consumption from the Turkstream pipeline in January 2023 in Greece. In the first 6 months (August-January) of the 8-month reduction period set by the ΕU, Greece is at -22.6% compared to the 5-year average, exceeding the EU target of -15%, and at -32% compared to the same period last year.

In force: European obligation to reduce fossil gas consumption during the period August 2022-March 2023 by 15% compared to the average of the same period of the previous five years or 2021, if the consumption had increased by more than 8% that year, a derogation for which Greece is eligible.

More specifically, according to the latest available data from the National Natural Gas Transmission System – DESFA (up to January 2023):

The month of January

In January 2023, the 6th month of the 8-month period where the country must reduce gas consumption in line with its European obligations, the total domestic consumption was 3.93 TWh, the lowest for the month of January for the last 6 years (at least). The overall decrease of 2.39 TWh in January compared to the same month in 2022 came primarily from the electricity sector (-1.56 TWh), secondarily from the distribution networks (-0.79 TWh), and much less from industry (-0.04 TWh), which had already started to reduce gas use since 2021.

Cumulative performance and the EU target of -15%

Due to the very large decrease in consumption in January, cumulatively in the first 6 months of the 8-month reduction period set by the EU-27, Greece, with a total consumption of 24.34 TWh “caught” and exceeded the reduction target of -15%, not only compared to the corresponding period of the previous year but also compared to the 5-year average (26.72 TWh).

More specifically, the cumulative consumption in the August-January 6-month period was 7.1 TWh lower than the average for the same period of the previous five years. In contrast to what was the case up to December 2022, the cumulative data up to January 2023 show that the main contributor to the 6-month consumption decline was the reduction in gas use for electricity generation (-3.24 TWh), which outperformed the corresponding reductions in industry (-2.6 TWh) and distribution networks (-1.24 TWh).

In terms of percentage changes, the country in the 6-month period August 2022-January 2023 reduced its total gas consumption by 32% compared to the same period of the previous year, far exceeding the reduction target corresponding to the derogation that Greece secured in the EU Regulation, according to which, it can calculate its performance in relation to the previous year and not the 5-year average. For the 4th consecutive month since the start of the reduction period in August, Greece is on track to achieve the -15% target, with a cumulative percentage reduction of 22.6% compared to the average of the corresponding six-month periods of the previous five years. Therefore, invoking the derogation is not necessary for the country to fulfil its EU obligation.

Moreover, all end uses show significant percentage decreases compared to the same 6-month period of the previous year. Industry leads the way (-54.7%), followed by distribution networks (-32.3%) and electricity generation (-29.7%). The percentage decreases in end-uses are similar with respect to the 5-year average as well, with industry, distribution networks and electricity generation exhibiting decreases of 69.8%, 19.9% and 15.1%, respectively.

Consumption in 2023

Continuing the downward trend of 2022, in January 2023, fossil gas consumption fell by 37.8% compared to January 2022. Also, January 2023 was the 10th consecutive month in which there was a decrease compared to the same month of the previous year (April 2022-January 2023).

In terms of the distribution of gas consumption among end-uses in January 2023, the large decrease in gas use for electricity generation this month also reduced the share of power generation in end-uses to 53% (from 73.5% during 2022). In contrast, distribution networks increased their share to nearly 41% in January 2023 (from 21.5% in 2022), while industry remained very low at 6% (was 5% in 2022).

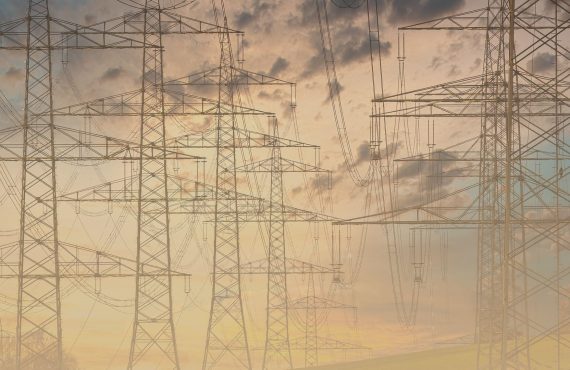

Imports in 2023

In terms of fossil gas flows from the country’s four entry gates, in January 2023, gas imports from Russia covering domestic consumption were zero, for the first time since the start of Russian gas imports to Greece through the Sidirokastro gate[1]. On the contrary, imports of liquefied fossil gas (LNG) through the Agia Triada gate continued to increase. The quantities of LNG imported by the country in January 2023 were 3.9% higher compared to January 2022. LNG was by far the main source of gas for the country in the same month with 3.9 TWh, a quantity practically equal to the total domestic consumption, with a 77.2% share of the total fossil gas flows imported by Greece. Imports from TAP via Nea Mesimbria decreased compared to January 2022 (-18.4%), contributing 1.09 TWh and occupying a share of 21.5%, while the quantity imported from Turkey via Kipoi was very low (0.07 TWh and a share of 1.3%).

Comparison with the EU

Based on the latest available Eurostat data on monthly gas consumption in the EU-27 Member States from January to November 2022[2], Greece reduced its consumption by 18. 7% compared to the same period in 2021 and moved up two places in the relevant ranking compared to the previous month, to reach the 11th position, 6 places higher than the EU-27 average (-12.8%). There was also an improvement compared to the 5-year average where Greece in November showed for the first time in 2022 a decrease in consumption (-3.2%). However, this performance is still one of the worst in the EU-27 (5th from the bottom behind Slovakia, Malta, Spain and Ireland).

Greece is less dependent on Russian gas for the first eleven months of 2022 compared to the EU average. Each month of 2022 Greece managed to reduce the imports of Russian gas used to cover domestic consumption compared to the same month in 2021, much more than the European average. Thus, cumulatively until November 2022, Greece reduced Russian gas imports by 68.4% compared to the same period in 2021, while the corresponding EU-27 average was 28.6%.

You can read the analyses of other months here.

[1] Overall imports from Russia were higher, but in January 2023 all of these were exported to Bulgaria.

[2] Some of the Eurostat data, especially for the last few months, are provisional and will be finalized in the coming months.