Analysis on the evolution of gross electricity production from different energy sources in EU-27 Members States since the beginning of the century as well as on the challenges for the future arising from the observed trends.

It was published in energia.gr on April 28, 2021 under the title (in Greek):

EU after Lignite and Coal

The full article follows.

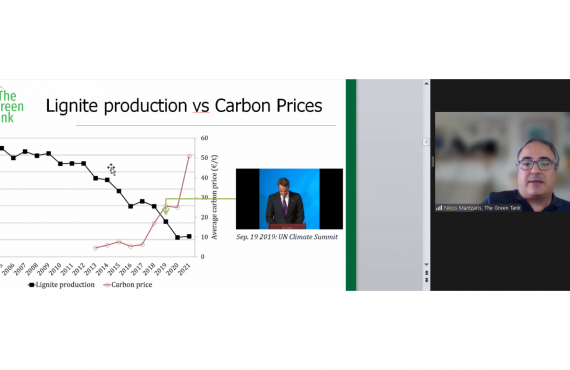

The observed fall in lignite- and coal-based electricity generation in EU-27 during recent years, has been monumental exceeding almost all predictions and expectations.

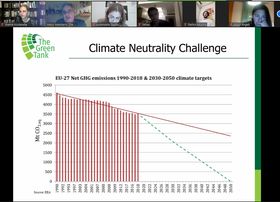

Proof of the catalytic effect of the European climate policy and especially the Emission Trading System (EU ETS) on this demise of coal is the fact that five years after the historic Paris Agreement, net electricity production from fossil fuels decreased in half, while in Greece the same levels of reduction (48%) occurred in just one year, between 2019 and 2020. The British think tank Ember estimates that if this reduction rate in the EU-27 is maintained, the electricity production from coal will cease completely by 2026.

At the backdrop of these developments, the forecasts of the National Energy and Climate Plans (NECP) in EU-27, are already outdated. They stipulate that in the current decade the rate of reduction in the use of lignite and coal for electricity generation will be half of that of the last 5 years. Given the forthcoming revision of the EU ETS Directive which seeks to align the emission cuts in the corresponding sectors with the new greenhouse gas emission reduction climate target by at least 55% by 2030, the reduction in coal and lignite use is expected to be much steeper. The Greek NECP in particular, which was completed in December 2019, has already been refuted by reality. Specifically, it predicted 8.1 TWh lignite-based electricity production in 2020, whereas last year lignite actually produced just 5.7 TWh of electricity, a deviation of 30%.

But how did we get here? What is the contribution of each Member State to these major lignite and coal reductions? Which other power generation technologies are declining and which are growing in their place?

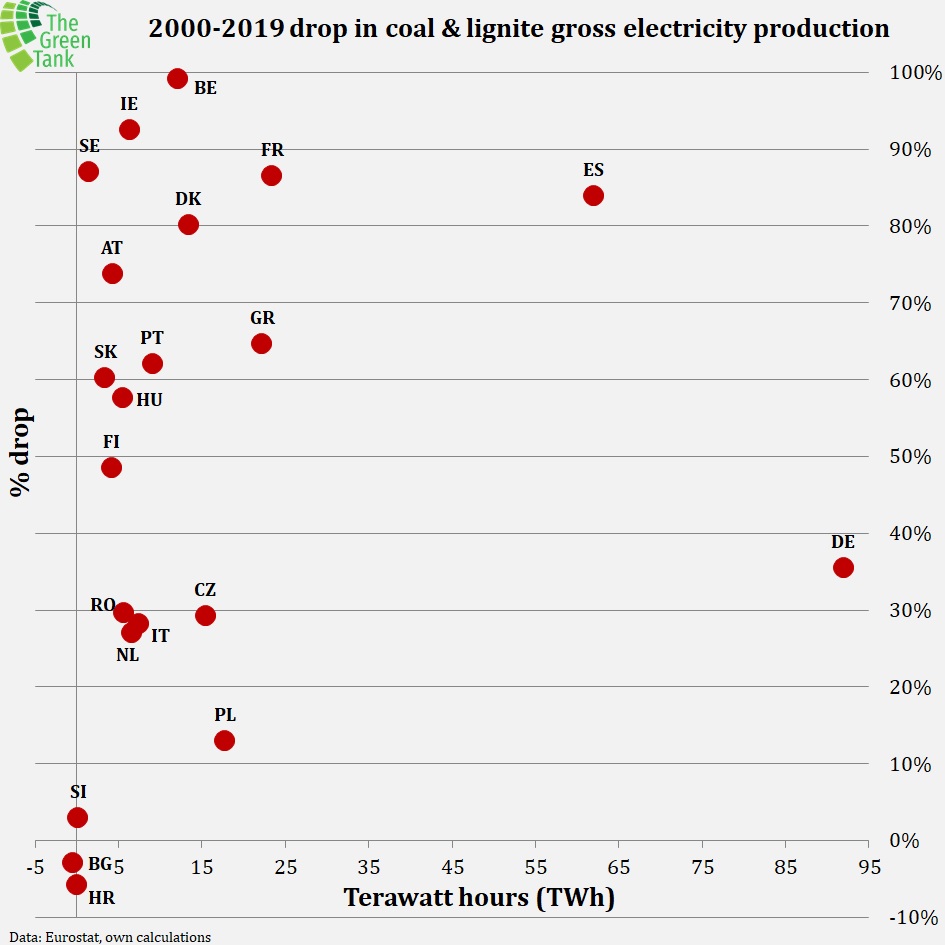

Lignite and Coal

Analysis of Eurostat data shows that Germany and Spain are responsible for half of the decrease of 311 TWh (42%) of gross electricity production from lignite and coal in the EU-27 between 2000 and 2019. It’s impressive that Greece, despite its small size, had the 4th largest contribution to this reduction, shrinking its gross lignite production by 22 TWh (65% reduction), with a very small difference from the 3rd France which at the same time reduced its coal share by almost 87%. At the same time, Poland achieved a reduction of only 17,8 TWh in electricity production from lignite and coal within the last 20 years, a quantity that translates into a reduction of only 13% in 2019 compared to 2000. Most of it occurred between 2018 and 2019. Exceptions to the general rule of falling coal and lignite shares are only Croatia and Bulgaria, which increased their electricity production from solid fossil fuels in 2019 compared to 2000, by almost 6% and 3% respectively.

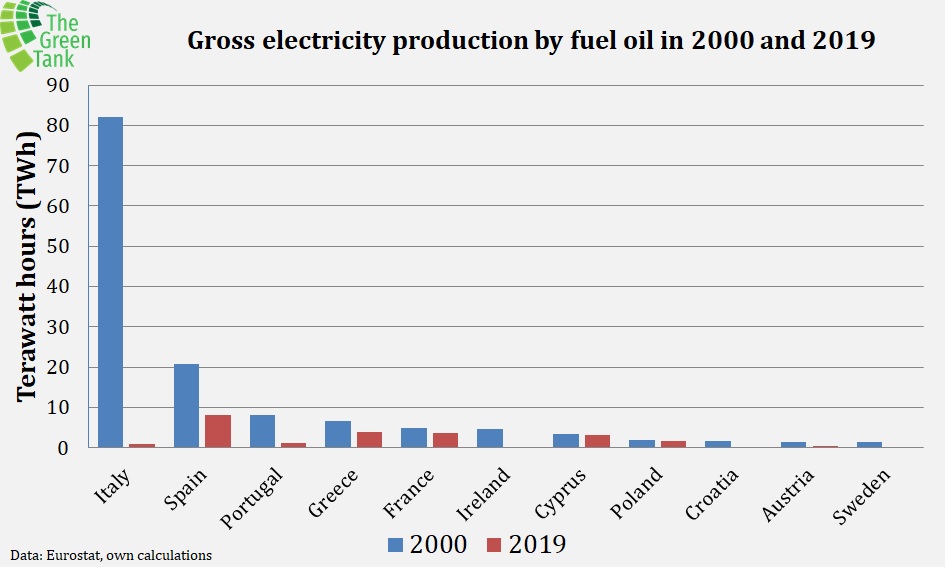

Oil

Oil

During the same period, gross oil-based electricity production declined by 115 TWh (82%), mainly due to the almost complete phase out of Italy (reduction by 99%), which in 2000 accounted for 58% of oil use in electricity generation in the EU-27. Now, Spain has the largest share with about 8 TWh. Spain nevertheless reduced the use of oil for electricity production by 62% compared to 2000 levels. The second place is currently occupied by Greece which achieved a much smaller reduction than Spain (44%) and continues to use oil for the electrification of its islands. This slower reduction is attributed to the delay of the electricity interconnections with the mainland but also to the slow deployment of renewables in the islands. France recorded a worse performance than Greece, holding the 3rd place in oil-based electricity generation, still producing 3.6 TWh in 2019, and reducing it only by 28% between 2000 and 2019. Cyprus is a major laggard practically maintaining the same levels of oil-generated electricity in the last 20 years.

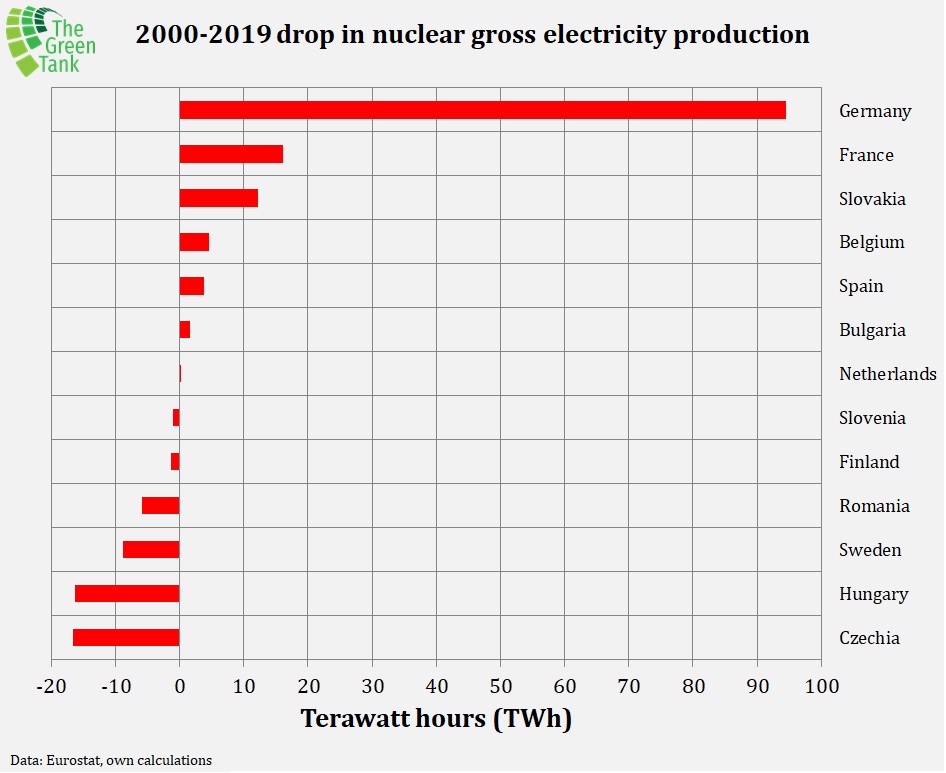

Nuclear Power

Nuclear Power

Nuclear energy exhibited a much smaller reduction of 83 TWh (-10%) between 2000 and 2019. The protagonist of this reduction was Germany, which reduced its nuclear power generation by 95 TWh in the last 20 years (-56%), while in 2011 pledged to close all its nuclear power plants by 2022. However, France which owns the largest share of nuclear power in the EU-27 (53% on average) achieved a very small reduction of only 3,9% between 2000 and 2019. In addition, 6 of the 13 EU Member States which use nuclear power in their electricity mix, increased their production with the most significant increases occurring in Czechia (+17 TWh), Hungary (+16 TWh) and Sweden (+9 TWh).

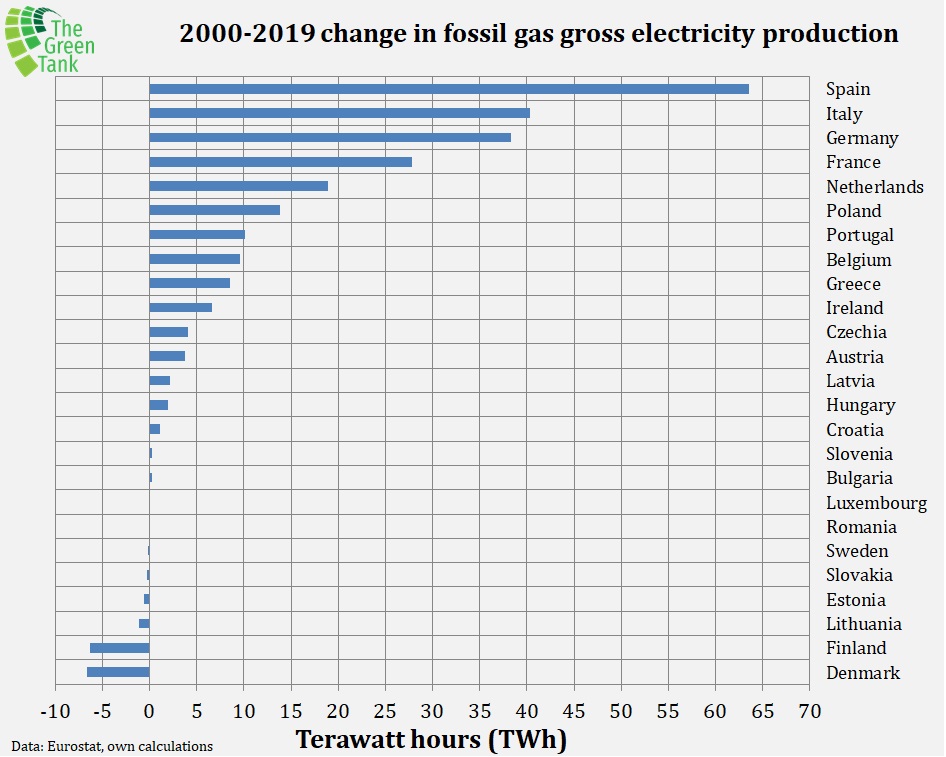

Fossil Gas

Fossil Gas

Contrary to solid and liquid fossil fuels, fossil gas exhibited a very large increase in electricity production of 238 TWh (72%) between 2000 and 2019. The largest contribution in this increase came from Spain with 63 TWh, followed by Italy (40 TWh), Germany (38 TWh), France (28 TWh) and the Netherlands (19 TWh). Poland, which is in 6th place, recorded the largest percentage increase, increasing the amount of electricity generated from fossil gas 10 times, from less than 1 TWh in 2000 to 15 TWh in 2019. The increase of electricity production from fossil gas in Greece by 8.6 TWh (145%) in the 2000-2019 period, was also significant. Only few member states have reduced their dependence on fossil gas, most notably Denmark by 6.7 TWh (-76%) and Finland by 6.3 TWh (-62%).

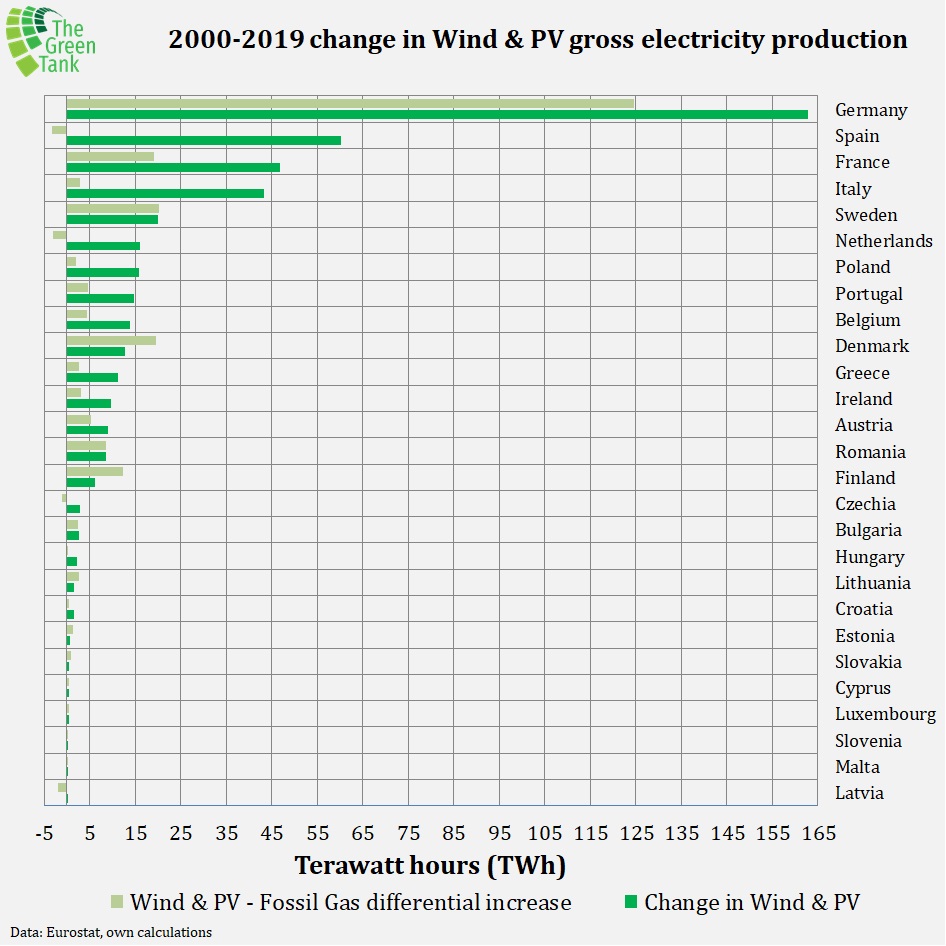

Wind and Solar Photovoltaic (PV)

Wind and Solar Photovoltaic (PV)

The largest increase in the last twenty years has been observed in the deployment of wind and solar photovoltaic (PV). The EU-27 increased its gross electricity production from the two most mature renewable technologies by 466 TWh between 2000 and 2019 (2178%). 79% of this increase came from wind (367 TWh) and the rest from PV. Germany contributed more than 1/3 to this rise in renewable electricity generation in EU-27 (163 TWh), followed by Spain (60 TWh), France (47 TWh) and Italy (43 TWh). Greece is ranked 11th in the relevant ranking with an increase of 11.2 TWh in wind and solar PV electricity generation between 2000 and 2019.

Comparing the increase in wind and solar PV with that of the fossil gas in the twenty years 2000-2019, it seems that only in 4 Member States (Spain, the Netherlands, Czechia and Latvia) the increase of fossil gas was more significant than that of renewables. Germany ranks first again having the highest differential increase (variable renewables minus fossil gas-based electricity production) of almost 125 TWh, followed by Sweden (+20 TWh) and France (+19 TWh). In Greece, the significant increase in wind and solar PV is almost eliminated due to the increase in the share of fossil gas in the electricity mix (+2.7 TWh), placing the country in the 13th place of the corresponding list, two spots below its ranking with respect to the increase of wind and PV-generated electricity.

Other Renewables

Other Renewables

From the remaining renewable technologies (bioenergy, hydro power, geothermal, solar thermal and wave energy), bioenergy had the most important growth, more than quadrupling its share in the EU-27 electricity mix from less than 20 TWh in 2000 to more than 80 TWh on 2019. Also, the production of geothermal electricity increased by 40% although it still remains at low levels (6.7 TWh in 2019). Electricity generation from water fluctuated during the twenty years 2000-2019, which were following changes in annual rainfall. In 2019 in particular it generated 345 TWh, losing the top spot among all renewable technologies, from wind energy (367 TWh). Lastly, solar thermal systems as well as those that utilize wave energy are still at nascent stages of development with the former being developed exclusively in Spain and the latter almost exclusively in France (exclusive until 2018). Thus, overall, other RES had a small increase since the millenium of 9%, producing 439 TWh in 2019.

Renewables or fossil gas?

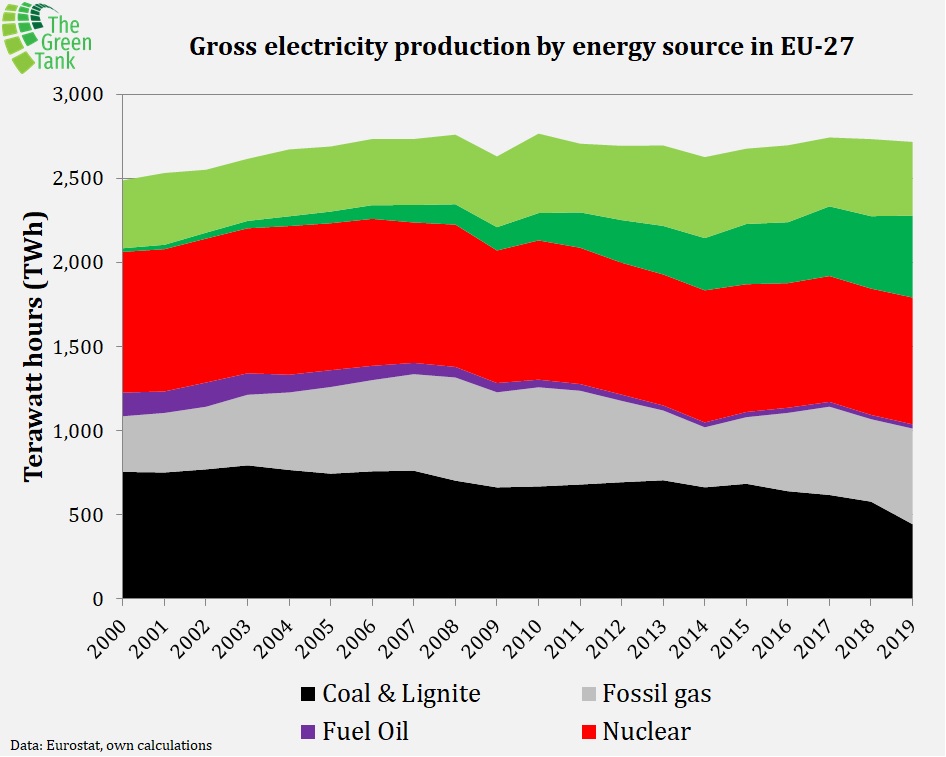

Looking at the overall evolution of the electricity mix in the EU-27 as a function of time, the huge increase of the share wind and solar PV, the smaller and more gradual increase of fossil gas and the rest of RES and the even slower decrease of nuclear power, is more efficiently visualized. Nuclear power remains the main source of electricity in EU-27, mainly due to its dominant position in the French power mix.

Given the continuation of the phase-out from solid and liquid fossil fuels in the EU-27, Germany’s complete phase-out from nuclear power and the major disadvantages of developing new nuclear power plants, the main question for the future of electricity generation in EU-27 is whether the contribution of these energy sources will be replaced by renewables or fossil gas. Obviously, the answer to this question will largely depend on the direction in which both private and public financial sources will move. The delegated act to be issued by the European Commission on which investment will henceforth be considered “sustainable” will undoubtedly play a decisive role.

Given the continuation of the phase-out from solid and liquid fossil fuels in the EU-27, Germany’s complete phase-out from nuclear power and the major disadvantages of developing new nuclear power plants, the main question for the future of electricity generation in EU-27 is whether the contribution of these energy sources will be replaced by renewables or fossil gas. Obviously, the answer to this question will largely depend on the direction in which both private and public financial sources will move. The delegated act to be issued by the European Commission on which investment will henceforth be considered “sustainable” will undoubtedly play a decisive role.

There are many Member States which want to allocate resources to the construction of new fossil gas infrastructure, which has in turn already influenced the European Commission to amend the original act that excluded fossil gas infrastructure from the list of sustainable investments and then postpone a decision on the matter. On the other hand, the European Commission itself, in the impact assessment accompanying the new 2030 EU climate target predicts that the achievement of this very target is associated with a reduction in the use of fossil gas between 32% and 37%. Therefore, new investments in fossil gas represent a major threat for the achievement of the new EU 2030 climate target of reducing net greenhouse gas emissions by 55% compared to 1990 levels, a target that is not even in line with scientific evidence requiring emission cuts of at least 65% by 2030.