Clean energy (renewables and large hydro) set a record by exceeding 50% (52.9%) of demand in the first half of 2024, and all fossil fuels (lignite, fossil gas and oil) combined. However, the increase in gas (+36.9% in the first six months of the year compared to 2023) still raises concerns. Its share in meeting demand (34.3%) could be reduced if the curtailment of renewable energy, which reached 494 GWh in the first half of the year, had been avoided. Net imports contracted, covering only 1.3% of total domestic demand, while lignite was down with a share of less than 6%.

This analysis covers electricity production across the whole territory of Greece and is based on the latest available monthly data from the Independent Power Transmission Operator (June 2024) for the interconnected grid and from the Hellenic Electricity Distribution Network Operator (HEDNO) for the non-interconnected islands (May 2024). In addition, we use the most recent data from HEDNO for low and medium voltage, as well as for the installed capacity of self-production systems (February 2024). The data from DAPEEP’s Renewable Energy Special Account bulletin up to April 2024 are used to calculate more accurately CHP production at low and medium voltage, as well as for the PV utilization factors needed to estimate self-production. You can read in more detail about our methodology here.

Producing 12,306 GWh in the first six months of 2024, renewables (excluding large hydro) exceeded the production of all three fossil fuels together (fossil gas, lignite and oil) by 96 GWh. In the same period in 2023, renewables contributed 423 GWh less than fossil fuels.

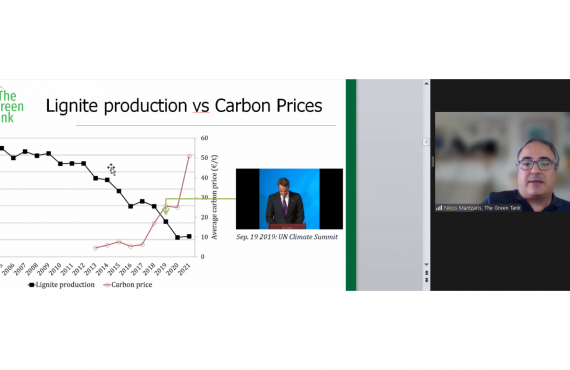

Fossil gas was second (9,148 GWh), returning to 2022 levels and showing an increase of 36.9% compared to the first half of 2023. Large hydro was in third place with 1,810 GWh, for the second time in the last decade, after the first half of 2021. Oil on non-interconnected islands followed in fourth place (1,564 GWh), even displacing lignite in fifth place for the first time (1,498 GWh). The smallest contribution to meeting demand in the first half of 2024 came from net imports (342 GWh), which was the lowest in the last decade for this period, well off the previous low of 2021 (2,188 GWh).

The large increases in fossil gas (+2,467 GWh) and renewables (+2,395 GWh), and much smaller increases in large hydro (+220 GWh) and oil (+46 GWh) in the first half of 2024, compared to the same period in 2023, offset the collapse in net imports (-3,200 GWh), the decline in lignite-fired power generation (-640 GWh) and the increase in demand (+1,286 GWh).

The corresponding percentage changes in the first six months of 2024, compared to 2023, were:

Lignite: -30%

Fossil gas: +36.9%

Renewables: +24.2%

Large hydro: +13.8%

Net imports: -90.3%

Oil: +3%

Demand: +5.1%

In the first six months of 2024, clean energy (renewables and large hydro) reached the highest of the decade with 14,116 GWh, up 22.7% compared to the same period in 2023 (11,501 GWh). In fact, it surpassed by almost 2 TWh (1,906 GWh) the electricity production from the three fossil fuels combined (11,501 GWh), which grew by a smaller 18.1% over the same period. This difference between clean energy and fossil fuels in the first six months widened in 2024 compared to 2023, when clean energy had exceeded fossil fuels for the first time by 1,163 GWh.

Clean energy met more than half of demand (52.9%) for the first time in the first six months of the year, while its share of net electricity generation was 53.6%. Renewables (mainly wind and solar) had the lion’s share in meeting demand with 46.1%, while large hydro covered 6.8% of demand. Fossil gas led the way among fossil fuels in meeting demand with a share of 34.3%, which is the largest share of the decade for the six-month period. Oil followed with 5.9% and finally lignite with 5.6%. Net imports covered just 1.3% of demand, the lowest share in a decade.

The share of renewables would have been even higher, if there were no curtailments. According to the forecasts of the consolidated planning process published daily by IPTO, a total of 494 GWh of RES were curtailed in the first six months of 2024. 122 GWh were curtailed in May, while the highest amount of clean energy was curtailed in April (259 GWh) compared to the other months of the year and the total of the 2023 curtailments (228 GWh). In June 64 GWh were curtailed, while the remaining 49 GWh were curtailed in March.

According to the same IPTO forecasts, on 30 June there was a high of 16.24 GWh of RES curtailments for the month of June, which was, however, considerably lower than the highs of previous months.

If the curtailments were avoided during the first six months of 2024, it would be possible to fully eliminate net electricity imports, since during the aforementioned period total net imports (342 GWh) were lower than the curtailments. Therefore, Greece could have become a net exporter of electricity for the first time or even reduce the share of fossil gas, while increasing the share of renewables. Alternatively, the full utilization of all renewables production through storage infrastructure could reduce by the same amount (494 GWh) the use of fossil gas, leading to lower electricity prices in the wholesale electricity market.

In June 2024:

– Electricity production from RES set an all-time record with 2,252 GWh. The previous high was recorded in August 2023 (2,249 GWh).

– Production from fossil gas (2,033 GWh) was the highest monthly in 22 months since August 2022 (2,230 GWh).

– Production from large hydro was the highest of the year (386 GWh).

– Demand (5,348 GWh) was up 24% compared to June 2023 and was the highest of the year.

Electricity consumption in the first half of 2024 (26,676 GWh) increased by 5.1% compared to the same period of the previous year, while it was only 1.3% lower than the average of the last five years (2019-2023). It is observed that demand growth has returned to the levels of the first month of the year (+6.7% in January), in contrast to recent periods when growth was closer to 1% (+1.4% in the first quarter compared to the same period in 2023, 1% in the four months and 1.2% in the five months).